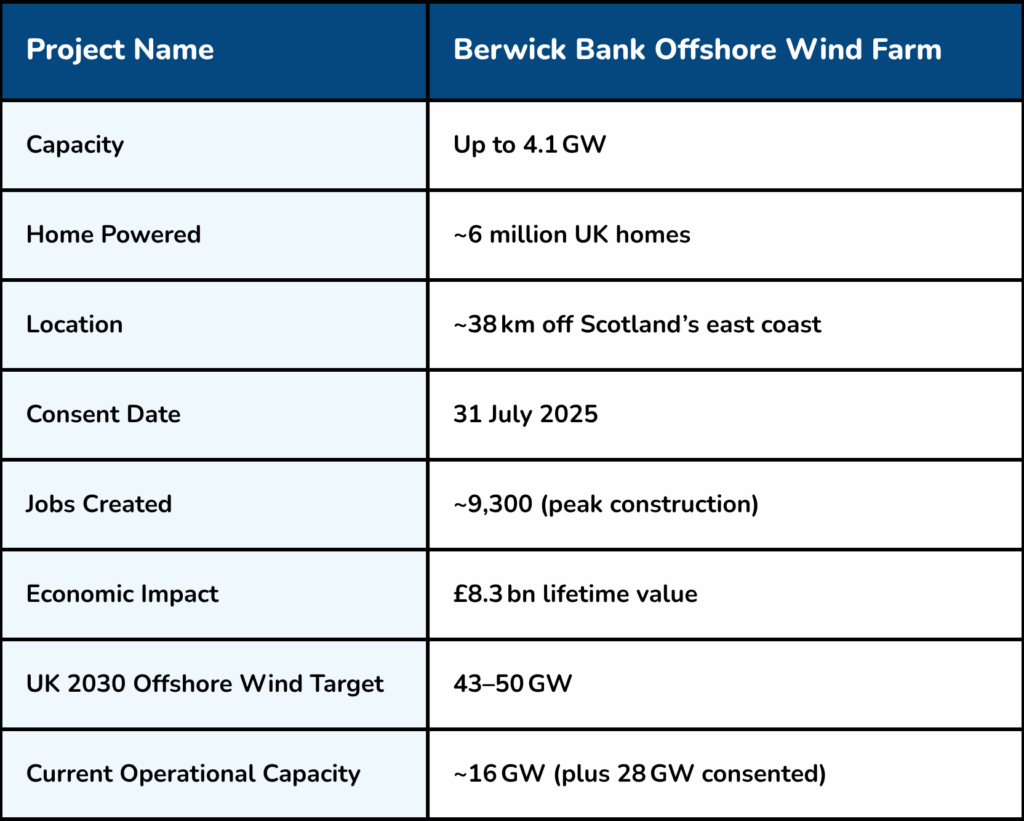

In a monumental leap forward for renewable energy, Scotland has officially approved the Berwick Bank Wind Farm, now poised to become the world’s largest offshore wind project. With consent granted on 31st July 2025 by the Scottish Government, the project—led by SSE Renewables—promises to significantly boost the UK’s clean energy capacity and solidify its position as a global leader in offshore wind.

Situated around 38 kilometres off the coast of East Lothian, Berwick Bank is projected to generate a staggering 4.1 gigawatts (GW) of electricity—enough to power more than six million UK homes. This scale not only makes it the largest offshore wind farm globally, but also a cornerstone in helping the UK achieve its Clean Power by 2030 ambitions.

Berwick Bank: Powering the Future of UK Energy

The project will feature up to 307 turbines, spread across a 1,010 km² area in the outer Firth of Forth. When completed, Berwick Bank will nearly double Scotland’s current offshore wind capacity and make a serious dent in the UK’s overall reliance on fossil fuels.

It’s not just a win for sustainability—the economic impact is substantial too. SSE Renewables estimates that the project will support up to 9,300 jobs during the peak construction phase, with more than 4,600 of those in Scotland alone. Over its lifespan, the wind farm is expected to generate an £8.3 billion boost to the UK economy.

However, the go-ahead does come with conditions. To address environmental concerns, especially those related to seabird habitats, the approval includes a requirement for a Seabird Compensation Plan. Organisations like the RSPB have voiced concerns over the potential impact on protected bird species, so this plan will play a crucial role in ensuring the project maintains ecological balance.

A Broader Look: The UK’s Offshore Wind Journey So Far

The approval of Berwick Bank represents the latest—and arguably most significant—milestone in the UK’s offshore wind journey. Over the past decade, the UK has undergone a profound transformation in its approach to renewable energy, with offshore wind at the heart of its decarbonisation strategy.

Setting The Stage For Leadership

The UK was one of the earliest adopters of offshore wind technology, with the first farms like North Hoyle (2003) and Scroby Sands (2004) marking the beginning of a long-term commitment to wind-powered electricity. Since then, the industry has grown exponentially—both in scale and sophistication.

By 2025, the UK boasts around 16 GW of operational offshore wind capacity, with a further 28 GW already consented. This positions the country second only to China in terms of global offshore wind capacity.

Game-Changing Developments

Flagship projects such as the Dogger Bank Wind Farm—the largest in Europe until now—have already begun producing electricity and are expected to reach full capacity by 2026, adding 8.1 GW to the national grid. Located in the North Sea, Dogger Bank set a new standard for technology and scale in renewable generation.

Another success story is the Neart na Gaoithe wind farm, off the coast of Fife. It began delivering electricity in late 2024 and will be fully operational by mid-2025. Meanwhile, the Inch Cape project, also in Scottish waters, continues to progress through construction phases with commissioning expected soon.

Alongside these new builds, the Crown Estate’s Capacity Increase Programme—announced in May 2025—has authorised further development on seven existing wind farm sites, adding an extra 4.7 GW to the UK’s pipeline.

A National Strategy In Action

All of this aligns with the UK Government’s Clean Power 2030 target, which calls for 43–50 GW of offshore wind capacity by the end of the decade. To help meet that goal, the government has recently:

- Extended Contracts for Difference (CfD) from 15 to 20 years, giving investors greater long-term confidence.

- Committed £400 million to upgrade ports and build out the wind energy supply chain.

- Fast-tracked the approval of 13 major projects in early 2025, releasing an additional 16 GW of potential clean power.

Challenges Still Loom

Despite these wins, the industry has not been without its challenges. Rising inflation, supply chain bottlenecks, and increasing capital costs have caused delays in some projects—most notably the pause on Hornsea 4, one of the UK’s largest proposed sites.

Still, with the Berwick Bank project now approved and an increasingly supportive policy landscape, the offshore wind sector remains one of the UK’s most promising tools for climate resilience, energy security, and economic growth.

What This Means for the UK’s Net Zero Goals

The green light for Berwick Bank is more than a headline—it’s a pivotal step toward achieving the UK’s net zero emissions by 2050 target. Offshore wind is the backbone of that mission, and with this approval, the UK has made it clear that it is not just keeping pace with global renewable ambitions—it is setting the pace.

As the world faces intensifying climate challenges, projects like Berwick Bank offer a glimpse into what a cleaner, more sustainable energy future looks like. With the right investments, political will, and continued innovation, the UK can truly lead the charge into a low-carbon era.